CALL US NOW (Mon-Fri, 8am – 5pm PST) ![]() for a FREE QUOTE

for a FREE QUOTE

FR44 Insurance Florida. You can’t drive legally in Florida without car insurance. The state requires every vehicle with four or more wheels to have auto insurance. Minimum auto insurance requirements in the state of Florida are $10,000 PDL (property damage liability) and $10,000 PIP (personal injury protection). The Florida DMV may require drivers who have been involved in at-fault accidents or have been found guilty of certain offenses to purchase additional coverage such as BIL (Bodily Injury Liability).

The Florida No-Fault Law requires auto insurance providers to provide coverage for their insured drivers regardless of who is at fault in any given accident. This ensures that all insured drivers receive financial protection and the necessary medical attention in the event of an accident. Drivers are also required to have proof of Florida Auto Insurance coverage when they register their cars with the Department of Highway Safety and Motor Vehicles (DHSMV).

Florida’s Financial Responsibility Law

Despite the fact that Florida drivers are required to have active insurance policies to register their vehicles, you may be required to present proof of insurance if you are pulled over by law enforcement officers. You can present either your insurance card or the declaration page of your auto insurance policy. If you are caught driving under the influence of drugs or alcohol or you happen to cause a serious accident, you may be asked to purchase addition auto insurance coverage to meet to meet Florida’s Financial Responsibility Law.

Despite the fact that Florida drivers are required to have active insurance policies to register their vehicles, you may be required to present proof of insurance if you are pulled over by law enforcement officers. You can present either your insurance card or the declaration page of your auto insurance policy. If you are caught driving under the influence of drugs or alcohol or you happen to cause a serious accident, you may be asked to purchase addition auto insurance coverage to meet to meet Florida’s Financial Responsibility Law.

Florida Financial Responsibility Requirements

In the event of an accident that results in bodily injury or property damage to other parties, the Florida Financial Responsibility Law requires the at-fault driver to have in effect — at the time of the accident — full liability insurance coverage. Drivers are only required to meet Florida Financial Responsibility requirements after committing certain offenses. Unlike in the majority of US states where drivers are required to file an SR22 form to meet financial responsibility requirements, Florida drivers are required to purchase the FR44 insurance policy. We seek to explain everything there is to know about FR44 insurance in Florida and give answers to the critical FAQs about FR44 insurance, so keep reading.

What Is FR44 Insurance Florida Policy?

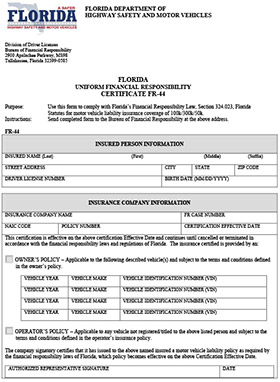

The Florida Statute 324.023 requires persons convicted of DUI in the state to obtain a minimum level of auto insurance coverage before the reinstatement of their driver’s license. They will also have to maintain this coverage for a predetermined period. This type of auto insurance is known to as FR44 insurance. While its typically referred to as ‘FR44 insurance’, FR44 is actually proof of coverage that your insurance provider sends to the Florida DMV showing that you have met the state-mandated auto insurance requirements. The FR44 will be filed by your insurance provider on your behalf. The Florida Statute 324.023 comes into play if you are involved in certain violations or when you do not meet the financial responsibility law requirements.

CALL US NOW (Mon-Fri, 8am – 5pm PST) ![]() for a FREE QUOTE

for a FREE QUOTE

What Is the Difference Between FR44 Insurance and SR22 Policy?

The ‘FR’ in FR44 insurance stands for ‘Financial responsibility.’ Also known as the FR44 Certificate of Minimum Insurance Coverage, FR44 insurance is very similar to an SR22 policy. The only major difference is that the FR44 is specific to DUI or DWI convictions while SR22 is specific to accidents or crashes that result in property damage, bodily injury, or death of another person. FR44 insurance also requires higher coverages. Your auto insurance minimum requirements will have to meet FR44 standards (which requires 10 times the liability limits of SR-22 certificates) if you are convicted of a DUI. Remember that you will only be required to purchase an FR44 insurance policy if you are convicted fora DUI or DWI.

What Are the Minimum FR-44 Insurance Requirements?

FR44 is an auto insurance policy with an endorsement similar to an SR22. However, FR22 insurance is stricter in terms of requirements and standards. For instance, FR44 coverage requires 10 times the liability limit of SR22 insurance. As of 1st October 2007, the state of Florida needs at least 100/300/50 in property protection and bodily injury coverages for FR44 insurance. That means that the insurer pays up to $100,000 per person injured and $300,000 per accident. If there’s damage to personal property, the insurance company will cover them up to $50,000. If the damages exceed these limits, the driver will have to cover the excess out of pocket.

FR44 is an auto insurance policy with an endorsement similar to an SR22. However, FR22 insurance is stricter in terms of requirements and standards. For instance, FR44 coverage requires 10 times the liability limit of SR22 insurance. As of 1st October 2007, the state of Florida needs at least 100/300/50 in property protection and bodily injury coverages for FR44 insurance. That means that the insurer pays up to $100,000 per person injured and $300,000 per accident. If there’s damage to personal property, the insurance company will cover them up to $50,000. If the damages exceed these limits, the driver will have to cover the excess out of pocket.

Do I Need to Purchase FR44 Insurance?

You might be required to obtain FR44 insurance to legally get back behind the wheel if you are convicted of a DUI or DWI in Florida or Virginia. If your license is suspended as a result of this offense, you must purchase FR44 insurance to prove to the state that you are covered by increased liability insurance. FR44 insurance is sometimes referred to as DUI insurance and only persons considered to be high-risk drivers are required to obtain it. Obtaining FR44 insurance is the only way to have your driver’s license and driving rights reinstated. Therefore, you don’t have a choice but file an FR44 if you want to drive your car again after a DUI conviction in the state of Florida.

What Convictions Require FR44 Insurance?

If you get in trouble behind the wheel in the Sunshine State, you may be required to file an FR44. The FR44 is mostly used to penalize those who have been caught driving under the influence of drugs or alcohol. DUI (Driving Under the Influence of alcohol or drugs) or DWI (driving while intoxicated) are very serious violations in Florida. However, there are other violations that might require the filing of an FR44 certificate in the state of Florida. These include being caught behind the wheel when your driver’s license is forfeited for conviction, causing death or bodily injury to another person with your car, and violating any local, state, or federal laws the state considers important.

How Long Do I Need to Carry FR44 Insurance in Florida?

How long do you need to carry FR44 insurance after a DUI conviction? The FR44 filing is generally required for three years from the date of conviction. You are required to have the FR44 coverage for three consecutive years without a lapse in coverage. If you don’t abide by these rules, your driver’s license will not be reinstated until you restart the three-year period again. However, it’s always good to confirm with the Florida DMV since the amount of time you’ll need to carry FR-44 insurance in Florida will vary depending upon the severity of your violation. For instance, if your driver’s license is suspended for five years, you will be required to maintain FR44 insurance for five years.

How Do I Purchase FR44 Insurance Florida?

The Florida FR-44 Form is simply a certificate of financial responsibility on a continuous basis. You must file for an FR44 certificate if you are convicted of a DUI or DWI — among other violations. The FR44 certificate shows limits of your auto liability insurance and must be filed with the Florida DHSMV from three years after the date of conviction. FR44 is insurance with an endorsement, it proves that you’ve met the state’s minimum auto insurance requirements. As a driver, you cannot file for an FR44 certificate on your own. You have to ask your insurance provider to file the FR44 form on your behalf.

You must meet the FR44 auto insurance requirements to file the FR44 form. Call your insurer as soon as you are notified to purchase FR44 insurance. If you don’t have an insurance provider, look for one who’s willing to file an FR44 form on your behalf — most insurance companies are prepared for such situations. After purchasing and verifying your minimum liability requirements, the insurance company will file the FR44 with the Florida DHSMV. You will need to pay a processing fee for the FR44 filing. Keep in mind that not all insurers provide FR44 insurance, and your request may be rejected a few times before you find an FR44 insurance provider.

CALL US NOW (Mon-Fri, 8am – 5pm PST) ![]() for a FREE QUOTE

for a FREE QUOTE

How Much Does FR44 Insurance Cost?

Filing an FR44 form will typically cost you around $25 in processing fees which is not much. The real cost of FR44 insurance is as a result of the increasing auto insurance rates. FR44 insurance is usually required for persons convicted of DUI or DWI. FR44 insurance is also referred to as DUI insurance or coverage for high-risk drivers. Your auto insurance provider will have to charge you more to cover that risk. As soon as you make a request for FR44 filing, your insurer will know that you’re a victim of DUI/DWI violation and consequently change your status to “high-risk.” FR44 insurance also comes with higher limits hence the increase in auto insurance premiums.

How Much Will an FR44 Certificate Increase my Premiums?

If your Florida driver’s license is suspended after a DUI conviction and you’re required to file an FR44 certificate, your auto insurance rates could increase by 200-300% from the amount you used to pay prior to the conviction. In some cases, auto insurance providers cancel or fail to renew car insurance policies after a policyholder has been convicted of a DUI or DWI. The cancellation of your coverage will lead to a further increase in your premiums with the new insurer. Maintaining car insurance can be very difficult after a DUI or DWI conviction in Florida because of the dramatic increase in the premiums.

Can I Obtain FR44 Insurance if I Don’t Have a Car? (Non-Owner FR44 insurance)

If you don’t have a car registered in your name, you can still be required to file an FR44 to reinstate your driver’s license in Florida. You can fulfill this obligation through non-owner’s FR44 insurance. This policy is similar to a standard auto insurance policy in that it provides property damage and bodily injury coverage for the policyholder. Non-owner’s FR44 insurance provides coverage when you get behind the wheel of a car you don’t own, for instance, when you borrow someone else’s car. By adding an FR44 endorsement to a non-owner’s policy, your insurance provider can help you fulfill FR44 requirements and have your license reinstated even if you don’t have a car.

What Happens After FR44 Insurance Coverage Lapse?

A lapse in your FR44 insurance coverage can have dire consequences for a driver with a DUI or DWI conviction. If you fail to maintain the minimum auto insurance coverage on your FR44 insurance after a DUI conviction, your FR44 insurance provider is obligated to report the lapse DHSMV. The DHSMV will, in turn, suspend your driver’s license. If that happens, the driver will have to file a new FR-44 Certificate of Minimum Insurance Coverage with the Florida DHSMV. You will have to find a new insurance company and purchase a new insurance policy that meets the minimum insurance coverage requirements in your FR44 certificate.

Also, the period for which you are required to hold on to the FR44 coverage will restart every time there is a lapse in coverage. Therefore, unless you are deliberately trying to sabotage the reinstatement of your driver’s license, don’t let your Florida FR44 auto insurance lapse. The Florida DHSMV imposes an increasingly expensive reinstatement fee every time a convicted driver has to reinstate his or her driver’s license due to a lapse in FR44 Certificate of Minimum Insurance Coverage. The reinstatement fee for the first suspension is $150, which increases to $250 and $500 for the second and third suspension respectively.

Buying FR44 Insurance in Florida

If you are convicted of a DUI or a DWI in Florida, a court order may be given to suspend your driver’s license. You will be required to obtain an FR44 certificate to reinstate your driver’s license and driving rights. You can only make the FR44 filing through an insurance provider. If you don’t have an auto insurance provider or if your auto insurance provider cancels your policy after a DUI conviction, you can easily find another insurance company that’s willing to file the FR44 on your behalf. Shop around until you find a policy that meets your FR44 requirements. If you are looking for FR44 insurance in Florida, we can help you out. Just fill out the form at the top of the page to get a quote. Alternatively, you can give us a call and speak to one of our agents.

CALL US NOW (Mon-Fri, 8am – 5pm PST) ![]() for a FREE QUOTE

for a FREE QUOTE

Insurance Disclaimer

This website is a free service to assist users in getting insurance quotes from insurance providers. This website is not affiliated with any state or government agency. This website is not an insurance agency or broker, nor an insurance referral service. This website does not endorse or recommend any participating Third-Party Insurance Providers that pay to participate in this advertising.